How to Write an Accountant Performance Review - Templates & Tips

Accountants work in a more technical environment compared to other professions. That’s why the accountant performance review must align with the role.

Accountants have to crunch numbers when preparing tax returns. They have to measure financial operations to help organizations run with efficiency. Their unique skill set is tied to analytical and computing knowledge.

For these reasons, you must create a unique accounting performance appraisal form.

This article contains notes on how to write accountant performance reviews. You’ll find template ideas and tips that will make the process easier.

- Creating an Accountant Performance Review With Template

- Examples of Accounting Goals

- Examples of Feedback and Phrases

- How Top Accounting Firms Conduct Performance Reviews

- FAQ and Resources

Creating an Accountant Performance Review With Templates

There are a lot of performance reviews to choose from when creating an accountant performance appraisal.

360-degree evaluations are gaining in popularity. This type of review is very effective, but it isn’t always the best choice for an accountant performance review.

An accountant's job description usually has more to do with competencies, proficiency, and accuracy. Their jobs are not always focused on leadership and team-based cooperation.

Although they interact in the office, peers may not have a lot to say about an accountant’s professional performance. Co-workers' experiences with the accountant isn’t relevant to the accountant's job duties.

External appraisals are often a better option for accountants who work with clients. These appraisals will provide a more holistic view of the accountant’s performance.

Competency assessments are another great choice. They are designed for jobs that are dependent on certain skills. A competency assessment determines which skills employees are good at. It can also highlight areas in which they need more training.

Assessments and rating scales should be paired with open-ended questions. That way you can recognize all employees for their successes—not just employees who work a certain way.

Looking for a quick way to get started on your accountant performance review? Check out our free performance appraisal templates:

These template can work as-is, or as a starting point to create a custom review template.

Examples of Accounting Goals

Goals are an important aspect of any performance review. After all, those who have goals are 10 times more likely to be successful than those who don't.

Measurable goals are especially effective because they enable you to precisely measure whether or not the goal was met. They are also appreciated by employees.

With a clear finish line, they know exactly when they have met their goal, or what steps they need to accomplish to meet it.

Employees with written goals are three times more successful than those with unwritten goals. Make sure you or your employees write down those goals so they can be referenced easily.

A tool like PerformYard can help you track and set goals for your employees, as seen below:

A few examples of goals that can be added to an accounting performance appraisal include:

- Reduce paperwork by a certain percentage by increasing the use of digital formats.

- Reduce a certain amount of reconciliation discrepancies by using a platform like QuickBooks more efficiently.

- Reduce past-due accounts by a certain percentage by utilizing a better billing reminder system.

- Reduce average invoice processing times by a certain percentage by creating new accounts receivable policies and procedures.

Goals that focus on reducing errors are a great way to measure success, but they don’t all have to focus on minimizing mistakes.

Goals can also focus on things like increasing the number of invoices processed or creating new revenue by securing additional financing. The goals do depend on each individual and their unique position.

Make sure each goal includes a target goal (like reducing paperwork), a KPI (by a certain percentage), and the means to achieve the goal (by increasing the use of digital formats). That way the goal is clear, measurable, and obtainable.

Good goals also enable the employee to provide input in the goal-setting process. Check out this free employee goal-setting template that is designed to walk employees through the process of setting goals step-by-step.

Examples of Feedback and Phrases

You might know what you want to say during your accounting employee performance review, but that doesn’t mean you know how to say it.

It’s important to include concise phrases in the review, but they should also be impartial. If you are delivering constructive feedback, observations should also be as accurate and measurable as possible.

A few positive performance review statements you can use as inspiration include:

- Accuracy and Precision: "Your meticulous attention to detail in financial reporting and analysis has greatly contributed to our firm's accuracy and reliability. This precision is essential in maintaining our clients' trust and satisfaction."

- Client Communication: "Your ability to communicate complex accounting information understandably and clearly to clients is commendable. This skill enhances client relationships and aids in their decision-making processes."

- Regulatory Compliance Knowledge: "Your up-to-date knowledge of accounting standards and regulations has been invaluable. This expertise ensures our firm consistently adheres to compliance requirements, mitigating risks for both our clients and our firm."

- Efficiency in Task Management: "Your efficient handling of tasks, even under tight deadlines, has been impressive. Your ability to manage time effectively ensures that client work is completed accurately and punctually."

- Proactive Problem-Solving: "You have consistently demonstrated proactive problem-solving abilities, especially in complex tax and audit assignments. Your foresight in addressing potential issues has been beneficial in streamlining processes and improving outcomes.

A few examples of constructive feedback include:

- Adaptability to Technological Changes: "In our rapidly evolving field, staying abreast of new accounting software and technologies is crucial. Embracing these tools can enhance your efficiency and accuracy in your work."

- Team Collaboration: "While your individual contributions are strong, increased collaboration with team members could lead to more comprehensive solutions for our clients. Sharing expertise and insights can enhance our team's overall effectiveness."

- Business Development Skills: "Expanding your involvement in business development activities could contribute significantly to our firm’s growth. Engaging in networking and client outreach can also provide opportunities for your professional growth."

- Continuous Professional Development: "The accounting field is constantly changing. Engaging more in continuous professional development will keep your skills sharp and up-to-date, which is essential for advancing in your career."

- Balancing Multiple Projects: "Managing your workload to efficiently balance multiple client projects can be improved. Enhancing your project management skills will help in delivering consistent quality across all assignments."

When delivered impartially, statements are about performance and not about the character of the person being reviewed. This means employees are less likely to be frustrated with the information.

You should also take a professional development approach to constructive feedback. If Dave struggles with presentations, you could offer the idea of sending him to a workshop or two that will help him develop his skills.

Reviews are also more effective if you come prepared with specific examples to back up your statements.

- What is an example of a time Mary eliminated unnecessary expenses?

- What mistakes were made while Mary was working on multiple accounts at the same time?

Your employees are more likely to improve when the review isn’t a personal judgment of character.

Looking for more inspiration? You can find sample phrases to share with your accounting workforce here.

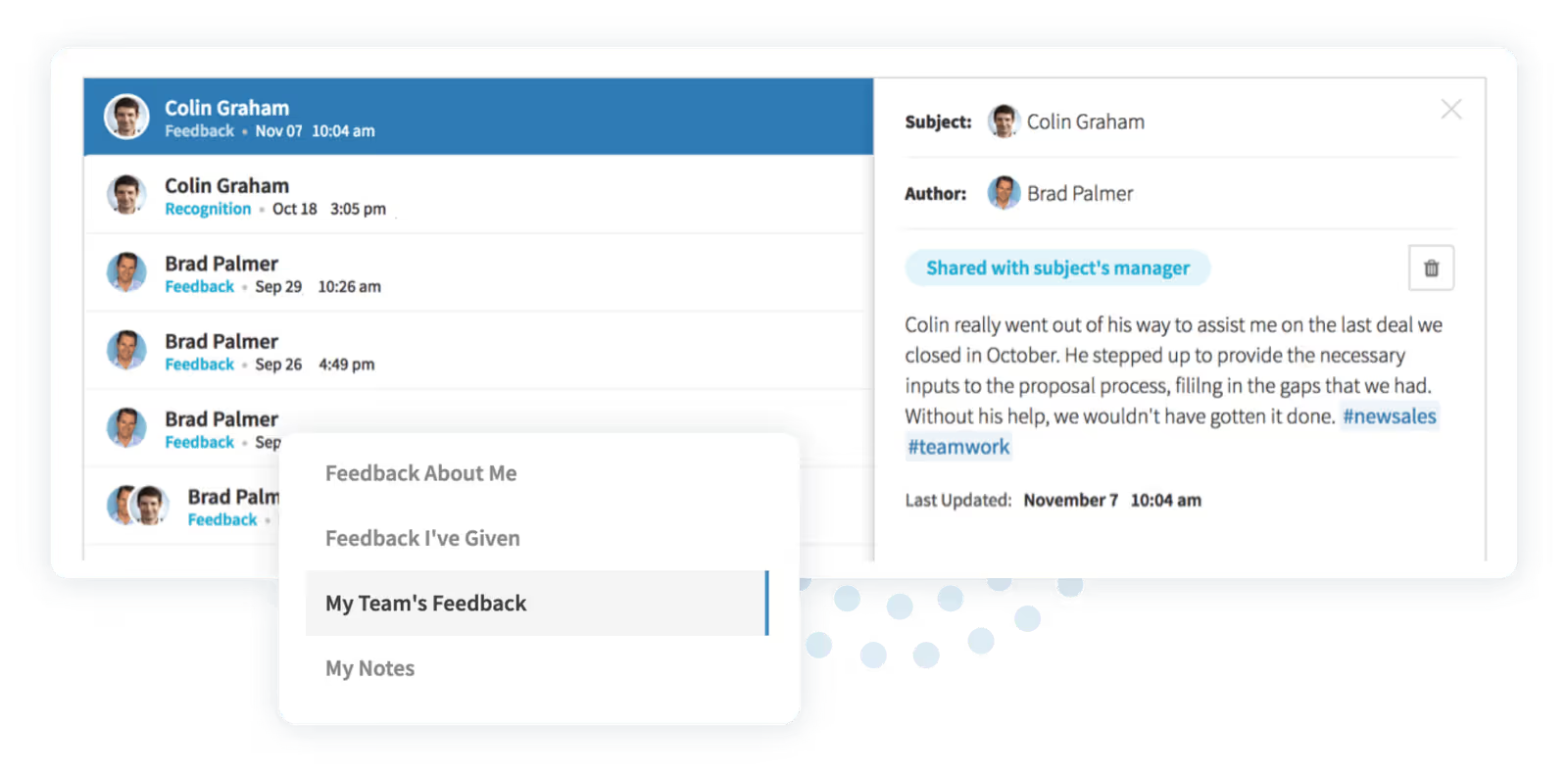

You can also facilitate the feedback using a tool like PerformYard. PerformYard allows companies to create a feedback culture and refer to past feedback during reviews.

How Top Accounting Firms Conduct Performance Reviews

Sometimes it’s helpful to see how top companies and others in your industry are tackling performance reviews. The big four accounting firms (Deloitte, EY, KPMG, and PwC) have a precise process that is designed to rate and categorize employees within each practice.

There are usually two review points, with one at the end of the fiscal year and another at the middle of the fiscal year.

Managers give ratings for personal performance and the top and bottom performers within a group or team.

Some accounting firms also use generic feedback. This kind of feedback is typically related to things like the:

- Ability to complete technical work

- Ability to communicate

- Ability to delegate

- Ability to understand responsibilities

- Ability to perform work with little guidance

- Relationships with clients

Deloitte takes a more personalized approach to the review process. They ask employees about motivation and development opportunities.

Deloitte also asks employees to mention ways to make the review process better. The company shows how employee input was used when making changes within the review process, and even the operation of the company.

You may want to do the same. A highly engaged workforce can increase profitability by over 20%. One of the best ways to engage team members is to make them feel like they are part of the decision-making process.

FAQ and Resources

What is a performance evaluation in accounting?

An accounting performance evaluation is designed to measure professional performance. The review usually includes a rating system that measures individual performance. It may also measure employee performance against other employees. Generic feedback can also be included, and many performance evaluations also include goal setting for the future.

The type of review that is used depends on the needs of the business. If you want to learn more about the big four accounting firms and how they do performance reviews, click here.

Do accountants fill out a self-evaluation ahead of a review?

Most performance reviews include a self-evaluation ahead of the review meeting. These forms usually include a summary of the work the employee completed during the review period.

The style and content of the self-evaluation will vary depending on the team that is creating the form. If you’re in the process of creating a self-evaluation form for your accounting team, check out the seven traits of effective self-review questions.

What are good goals for an accountant?

Here are a few examples:

- Reduce paperwork by a certain percentage by increasing the use of digital formats.

- Reduce a certain amount of reconciliation discrepancies by using a platform like QuickBooks more efficiently.

- Reduce past-due accounts by a certain percentage by utilizing a better billing reminder system.

- Reduce average invoice processing times by a certain percentage by creating new accounts receivable policies and procedures.

Where can I find accountant performance review samples?

Check out PerformYard’s 14 different types of performance appraisals here. If you’re wondering how best to phrase individual statements within each performance review, you can find more ideas here.